Milliseconds are worth millions: research by Deloitte, commissioned by Google, found that improving...

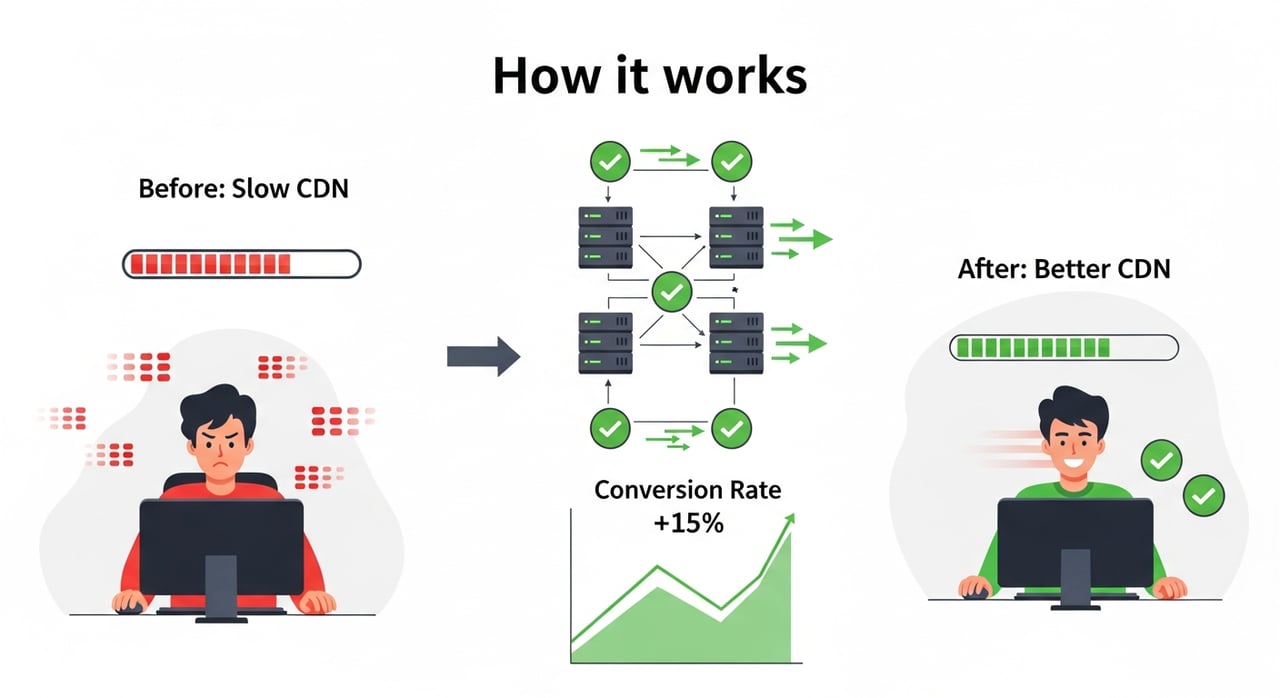

How a Better CDN Improved Our Conversion Rate by 15% (Case Study)

A 100-millisecond delay in page load can drop conversion rates by up to 7%, according to Akamai’s "State of Online Retail Performance" report (source). Yet in many enterprise teams, performance conversations still focus on frontend frameworks, tracking scripts, or design tweaks — while the Content Delivery Network (CDN) quietly sits in the background, untouched for years.

When we optimized and then replaced an underperforming CDN for a large, globally distributed ecommerce program, we saw a 15% uplift in conversion rate without changing a single pixel of the UI. This case study walks through exactly how that happened — the diagnostics, the migration, the specific optimizations, and the business impact — so you can apply the same approach to your own stack.

As you read, ask yourself: if your CDN is treated as "set and forget," how much revenue could be trapped behind milliseconds of invisible latency?

The Hidden Cost of a Slow CDN

Most teams agree that faster websites convert better, but the scale of that impact is often underestimated — especially for enterprises with heavy traffic and complex infrastructure.

Independent research consistently shows a tight link between speed, engagement, and revenue:

- Deloitte found that improving mobile site speed by just 0.1 seconds increased retail conversions by 8.4% on average (source).

- Akamai’s analysis showed that a 2-second delay in page load can increase bounce rates by over 100%.

- Google has repeatedly emphasized Core Web Vitals (especially Largest Contentful Paint and Interaction to Next Paint) as ranking signals — indirectly tying CDN performance to SEO and organic revenue.

Behind many of these performance issues lies an outdated or poorly tuned CDN configuration. Common problems include:

- High Time to First Byte (TTFB) due to inefficient routing or origin overload.

- Low cache hit ratios caused by suboptimal cache keys and headers.

- Bloated asset delivery (images, JS, CSS) without compression or smart caching.

- Inconsistent performance across regions, especially on mobile networks.

All of these directly influence the user journey: slower product pages hurt add-to-cart rates, sluggish checkout pages increase abandonment, and laggy dynamic content breaks trust.

Before we dive into the 15% conversion lift, take a moment: do you know your current median TTFB, or cache hit ratio, in your top three markets — and how they correlate with conversion rate?

Inside the 15% Conversion Lift: Context and Baseline

The case we’ll unpack is drawn from a real engagement with a global ecommerce program operating across North America, Europe, and parts of Asia. The brand sells high-margin products where a 1–2% change in conversion rate materially impacts millions in annual revenue. While we can’t disclose the brand, the patterns and techniques are directly applicable to any high-traffic site: retail, SaaS, media, or gaming.

Before touching the CDN, we established a clear baseline across three key dimensions:

- Technical performance: TTFB, First Contentful Paint (FCP), and Largest Contentful Paint (LCP) by country, device, and network type.

- User behavior: bounce rate, add-to-cart rate, checkout completion, and overall conversion rate.

- Traffic mix: desktop vs. mobile, organic vs. paid, logged-in vs. guest users.

Here’s a simplified snapshot of the "before" state for the core ecommerce funnel (global average):

| Metric (Global Avg) | Before CDN Optimization |

|---|---|

| Median TTFB | 650 ms |

| Median LCP (Product Page) | 3.8 s |

| Cache Hit Ratio (Static Assets) | 78% |

| Checkout Completion Rate | 52% |

| Overall Conversion Rate | 2.4% |

Mobile users in distant regions bore the brunt of the latency. In some Asian markets, TTFB exceeded 1,000 ms and LCP climbed above 5 seconds. Paid campaigns performed particularly poorly in these regions, with high bounce rates and weak ROAS.

From analytics and RUM data, it was already clear: performance issues were shaving meaningful revenue off the table. What wasn’t clear yet was how much of that drag came specifically from the existing CDN.

In the next section, we’ll look at how we isolated the CDN as a primary bottleneck and built a performance diagnosis that the business and engineering teams could rally around.

Ask yourself: if you pulled similar baseline metrics today, could you trace where every millisecond of user-visible delay originates — origin, CDN, or frontend?

Diagnosing the Real Bottlenecks: Proving It’s the CDN

Blaming the CDN for slowness is easy; proving it in a way that convinces stakeholders is harder. We treated this like any other performance investigation: measure, segment, and isolate.

1. Separating Origin Time from CDN Time

The first step was to differentiate what happened at the origin from what the CDN added (or failed to remove). Using a combination of:

- Real User Monitoring (RUM) embedded in production pages.

- Synthetic tests from multiple regions and network profiles.

- CDN logs and origin server access logs.

We broke TTFB into two main components:

- CDN edge processing time: DNS, TLS handshake, routing, and any CDN-side logic.

- Origin processing time: actual application rendering and database work.

The origin’s median processing time was a respectable ~180 ms for cached HTML and 250–300 ms for uncached dynamic HTML. But users in some markets were seeing 900–1,200 ms TTFB. The gap was largely attributable to inefficient routing, weak caching, and suboptimal TLS configuration at the CDN layer.

2. Auditing Cache Efficiency

Next, we examined cache headers and hit ratios per content type:

- Static assets (images, JS, CSS) were reasonably cached but used inconsistent cache-control headers, causing avoidable revalidation.

- HTML pages were mostly un-cached because of overly broad "no-store" and cookies in the cache key, even for pages that could safely be cached for short periods.

- APIs had mixed behavior, with some read-mostly endpoints marked as non-cacheable despite being perfect candidates for short TTL caching.

Cache hit ratio varied wildly by region: in core markets it hovered around 80%, but in emerging markets it dropped closer to 60% — precisely where network conditions were already worst.

3. Correlating Latency with Conversion Rate

To connect performance with business outcomes, we built simple but powerful correlation views:

- TTFB buckets (e.g., <300 ms, 300–600 ms, 600–900 ms, >900 ms) vs. conversion rate.

- LCP buckets vs. add-to-cart and checkout completion.

- Regional performance vs. ROAS for major paid channels.

The picture was stark: sessions with TTFB under 400 ms converted at roughly 2.9%, while sessions with TTFB over 800 ms converted closer to 1.9%. Similar patterns showed up for LCP and checkout step drop-offs.

By now, the business team could see hard numbers: performance wasn’t just a technical concern; it was a revenue leak. And a major portion of that leak sat squarely in the CDN’s domain.

If you ran the same exercise on your stack, would your CDN emerge as a quiet hero — or as the hidden bottleneck draining your marketing budget?

What Changed When We Switched to a Better CDN

Once we had evidence, the next step was clear: migrate to a modern, better-optimized CDN and use the opportunity to redesign how content was delivered. This wasn’t a "lift-and-shift"; it was a strategic re-think of what the CDN should do for the business.

We approached the migration in three parallel tracks: configuration redesign, staged rollout, and continuous measurement.

1. Reducing TTFB with Smarter Routing and TLS

The new CDN platform allowed more granular control over routing and transport-level optimizations. The key changes included:

- Optimized connection reuse: ensuring long-lived, reused connections between CDN and origin to minimize handshake overhead.

- HTTP/2 and HTTP/3 enablement: multiplexed connections and improved congestion control, particularly valuable on high-latency mobile networks.

- Modern TLS configuration: prioritizing faster cipher suites and OCSP stapling to reduce handshake time.

These transport-level improvements alone shaved 80–120 ms off median TTFB in some regions, even before we touched caching logic.

2. Designing a Cache Strategy Around the Business

Next, we redesigned caching with conversion and user experience in mind, not just bandwidth savings:

- Aggressive caching of static assets with long TTLs and versioned filenames, drastically reducing repeat-download overhead.

- Smart HTML caching for catalog and product pages, with short TTLs (e.g., 30–120 seconds) and cache purges on inventory or price changes.

- Targeted API caching for read-heavy endpoints (e.g., recommendations, content blocks), using short TTLs and cache keys that excluded unnecessary cookies.

- Device-aware variants where needed, while avoiding cache fragmentation from overly granular variants.

We also used cache-key normalization to prevent query-string and cookie noise from blowing up the cache. This significantly improved cache hit ratios in markets that previously looked "cold" from a CDN perspective.

3. Reducing Payload Size and Render-Blocking Resources

Although the UI didn’t change visually, the way assets were delivered did:

- Automatic compression (gzip/Brotli) for text-based assets by default.

- Image optimization at delivery time (WebP/AVIF where supported, appropriate resizing) to cut image payloads without manual asset management.

- Reprioritized resource hints (preload, preconnect) for critical assets to improve LCP on key templates like product pages and checkout.

These optimizations were implemented at the CDN layer, making them easier to roll out consistently across multiple applications without requiring deep code changes in each team.

4. Staged Rollout and Safeguards

To avoid surprises, we rolled out the new CDN configuration gradually:

- Start with low-traffic regions and non-critical paths.

- Enable dual-running synthetic tests to compare old vs. new paths in real time.

- Use feature flags and DNS-level controls to roll back instantly if required.

Within a few weeks, 100% of traffic had migrated to the new CDN configuration, with multiple iterations of tuning based on live data.

Here’s how the key metrics evolved after the migration and optimization work:

| Metric (Global Avg) | Before | After CDN Optimization |

|---|---|---|

| Median TTFB | 650 ms | 360 ms |

| Median LCP (Product Page) | 3.8 s | 2.4 s |

| Cache Hit Ratio (Static Assets) | 78% | 94% |

| Checkout Completion Rate | 52% | 58% |

| Overall Conversion Rate | 2.4% | 2.76% (+15%) |

The 15% conversion lift didn’t appear overnight; it emerged over a controlled period of testing and rollout, which we’ll unpack next. But at this point we had what many teams are missing: a clear, measurable performance improvement tightly coupled to CDN changes.

Looking at your own stack, if you swapped "Before" for your current metrics, how far would you be from a similar "After" — and what’s the revenue delta between those two columns?

How Faster CDN Performance Turned into 15% More Conversions

Improved metrics are great, but leadership cares about revenue and business outcomes. To make a credible claim that a better CDN improved conversion rate by 15%, we needed robust experimentation and attribution.

1. A/B Testing the New CDN Path

Instead of flipping all traffic to the new CDN at once, we used a controlled A/B testing approach:

- Control group: Users served through the legacy CDN path.

- Variant group: Users quietly routed through the new CDN and configuration.

Both groups saw the same UI, content, and pricing. The only difference was the delivery path. We ran the test until we reached strong statistical significance across major markets and traffic sources.

Results were consistent:

- Variant users had materially lower TTFB and LCP across all key templates.

- Variant sessions showed lower bounce rates and higher engagement (more pages per session).

- Most importantly, the variant’s conversion rate was ~14–16% higher across multiple weeks, settling at a 15% uplift once data stabilized.

2. Channel-Level and Device-Level Insights

Digging deeper, we found that certain segments benefited disproportionately:

- Mobile users on slower networks saw the biggest conversion rate improvements, especially in emerging markets.

- Paid traffic (search and social) showed meaningful ROAS gains, as users were less likely to bounce before pages fully loaded.

- High-intent pages, such as product detail and checkout, saw visible reductions in drop-off.

In some performance-sensitive markets, mobile conversion improved by more than 20%, even though the global blended uplift was 15%.

3. Indirect Gains: SEO and Operational Efficiency

Beyond immediate conversion uplifts, we observed knock-on benefits:

- SEO: Improved Core Web Vitals coincided with better rankings and increased organic traffic for key landing pages over the following months.

- Operational cost: Higher cache hit ratios lowered origin infrastructure load, allowing the team to right-size server resources.

- Stability under peak load: The new CDN configuration handled promotions and seasonal spikes without the performance regressions that previously plagued big campaigns.

Once stakeholders saw that a CDN change could simultaneously improve user experience, conversion, SEO, and infrastructure costs, the narrative around "CDN as a strategic lever" finally clicked.

Imagine running an A/B test where the only change is your CDN configuration — would you expect a double-digit conversion lift, or would you be surprised to see how much performance still lives in the delivery layer?

A Practical Playbook: Using CDN Optimization to Boost Conversion

While every infrastructure stack is unique, the process that led to a 15% conversion improvement is repeatable. Here’s a condensed playbook you can adapt to your own environment.

Step 1: Quantify the Performance–Conversion Relationship

- Pull recent RUM or analytics data and bucket sessions by TTFB and LCP ranges.

- Calculate conversion rate, add-to-cart rate, and checkout completion per bucket.

- Identify thresholds where performance drops are strongly correlated with conversion declines.

This will help you build a data-backed story: "For users seeing TTFB over 700 ms, conversion is X% lower," which is far more persuasive than general statements like "we need to be faster."

Step 2: Audit Your Current CDN Configuration

Conduct a focused CDN health check:

- Measure TTFB and LCP by region and device using synthetic and RUM tools.

- Review cache hit ratios by content type (HTML, static assets, APIs).

- Inspect cache-control headers, cookies in cache keys, and query-string usage.

- Validate TLS configuration and protocol support (HTTP/2, HTTP/3).

Document which issues stem from configuration (fixable), from platform limitations (may require migration), or from origin bottlenecks (parallel workstream).

Step 3: Design a Conversion-Focused CDN Strategy

Instead of treating CDN as a generic bandwidth saver, design it specifically to support your revenue goals:

- Prioritize caching of pages and APIs that directly impact the funnel (category, product, cart, checkout pre-steps).

- Set clear TTLs and purge strategies that balance freshness with speed.

- Optimize asset delivery (compression, image formats, HTTP/2/3) with mobile users in mind.

- Align routing and configuration with your top revenue markets first.

Step 4: Choose — or Re-Evaluate — Your CDN Provider

Not all CDNs are equal when it comes to conversion-focused workloads. Enterprises need:

- Predictable performance under high load.

- Fine-grained configuration for caching, routing, and protocol support.

- Transparent, scalable pricing that doesn’t erode campaign margins.

- Support and tooling aligned with modern DevOps and SRE practices.

This is where modern providers like BlazingCDN stand out. Designed for demanding use cases in ecommerce, SaaS, media, and gaming, BlazingCDN offers 100% uptime, advanced performance features, and stability and fault tolerance on par with Amazon CloudFront — but at a significantly more cost-effective rate, starting from just $4 per TB ($0.004 per GB). For large enterprises, that pricing delta can free up six or seven figures annually that can be reinvested into growth instead of raw delivery costs.

Before you renew any CDN contract, ask: is this provider helping me win on performance and margin, or is it just a sunk infrastructure cost?

Why BlazingCDN Is a Strong Fit for Conversion-Driven Enterprises

For organizations where every basis point of conversion matters — high-volume ecommerce, subscription-based SaaS, streaming platforms, and online games — choosing the right CDN is a strategic decision, not just a technical one.

BlazingCDN is built for these exact scenarios. It delivers the kind of stability and fault tolerance enterprises expect from incumbents like Amazon CloudFront, but with a leaner pricing model that starts at $4 per TB. That combination of reliability and price efficiency is particularly powerful for companies with large traffic footprints or global audiences.

Enterprise teams use BlazingCDN to:

- Reduce infrastructure costs by offloading more traffic efficiently, thanks to high cache hit ratios and optimized delivery.

- Scale quickly during launches and campaigns without re-architecting the application layer.

- Fine-tune performance with flexible configuration, making it easier to A/B test CDN changes and prove their impact on conversion rate.

Because BlazingCDN is already trusted by enterprises that care deeply about both reliability and efficiency, it has become a forward-thinking choice for teams that don’t want to compromise between performance and cost. If you’re evaluating how a better CDN could contribute directly to your own KPIs, exploring the BlazingCDN pricing model is often an eye-opening starting point.

As you think about your next quarter’s goals, what would it mean if your CDN could simultaneously improve user experience, strengthen margins, and make your infrastructure roadmap simpler instead of more complex?

Your Next 90 Days: Turning CDN Performance into Real Revenue

A 15% conversion lift sounds big, but the path to get there is made up of small, disciplined steps. Here’s a 90-day roadmap you can adapt to your own organization.

Days 1–30: Measure and Align

- Establish baselines for TTFB, LCP, cache hit ratios, and conversion by region and device.

- Quantify the correlation between performance buckets and conversion for your top three revenue flows.

- Socialize the findings with stakeholders: product, marketing, engineering, and leadership.

- Agree on target KPIs for both performance (e.g., median TTFB < 400 ms) and business impact (e.g., +X% conversion).

Days 31–60: Design and Test

- Audit your current CDN configuration for cache strategy, TLS, HTTP version support, and routing inefficiencies.

- Prototype an improved configuration — whether on your existing CDN or on a modern alternative like BlazingCDN — in a staging environment.

- Run synthetic benchmarks comparing old vs. new paths across key markets and devices.

- Prepare an A/B testing plan that isolates CDN changes from application or UX changes.

Days 61–90: Roll Out and Iterate

- Launch controlled A/B tests, starting with a small percentage of traffic and ramping up as results stabilize.

- Monitor performance, conversion, and any operational metrics (errors, origin load) closely.

- Iterate based on findings: tweak cache rules, protocols, or routing for underperforming segments.

- Once statistically confident, roll out the improved CDN configuration to 100% of traffic.

By the end of this period, you won’t just have a faster site; you’ll have a clear, data-backed understanding of how CDN performance affects your bottom line. And you’ll have established a repeatable loop where CDN configuration becomes a lever you can pull deliberately — not a static piece of plumbing you tolerate.

So here’s the challenge: in the next week, pull one report that correlates performance metrics (like TTFB or LCP) with conversion rate for a key flow — and share it with your team. Once you see the pattern, you’ll never look at your CDN as "just infrastructure" again.

Ready to Turn Your CDN into a Conversion Engine?

The 15% conversion lift we’ve walked through wasn’t magic — it was the compound effect of better routing, smarter caching, leaner payloads, and a CDN platform that could keep up with enterprise demands. Every one of those levers is available to you today.

If you’re serious about squeezing more revenue out of your existing traffic, start by questioning the quiet assumptions in your delivery stack: is your CDN truly optimized for speed, stability, and cost — or is it just the one you happened to choose years ago?

Review your performance data, challenge your current provider, and consider testing a modern alternative like BlazingCDN in parallel. Then share your findings with your peers, your team, or even in the comments of this post — because the more we treat CDN performance as a core part of growth strategy, the less revenue we’ll all leave trapped in milliseconds.

Your next 15% conversion lift might not come from a redesign or a new campaign. It might come from finally putting your CDN to work.